Understanding the Benefits and Application Process of Sallie Mae International Student Loan

#### Sallie Mae International Student LoanThe **Sallie Mae International Student Loan** is a financial product designed specifically for international stude……

#### Sallie Mae International Student Loan

The **Sallie Mae International Student Loan** is a financial product designed specifically for international students who are looking to fund their education in the United States. This loan can cover various educational expenses, including tuition, books, and living costs. For many international students, securing adequate funding is crucial to achieving their academic goals, and Sallie Mae provides a viable solution with competitive rates and flexible terms.

#### Who Can Apply for Sallie Mae International Student Loan?

International students enrolled in eligible degree programs at accredited U.S. institutions can apply for the Sallie Mae International Student Loan. It's important to note that applicants must have a creditworthy U.S. citizen or permanent resident co-signer to qualify for the loan. This requirement ensures that the loan is backed by someone with a stable financial history, reducing the risk for the lender.

#### Key Features of Sallie Mae International Student Loan

1. **Loan Amount**: The loan amount can range from $1,000 up to the total cost of attendance, minus any other financial aid received. This flexibility allows students to borrow only what they need.

2. **Interest Rates**: Sallie Mae offers competitive interest rates that can be either fixed or variable. Students can choose the option that best fits their financial situation and long-term plans.

3. **Repayment Options**: Borrowers have several repayment options, including interest-only payments while in school and full deferment until after graduation. This feature helps ease the financial burden during the study period.

4. **No Prepayment Penalty**: Students can pay off their loans early without facing any penalties, allowing them to save on interest if they are able to make extra payments.

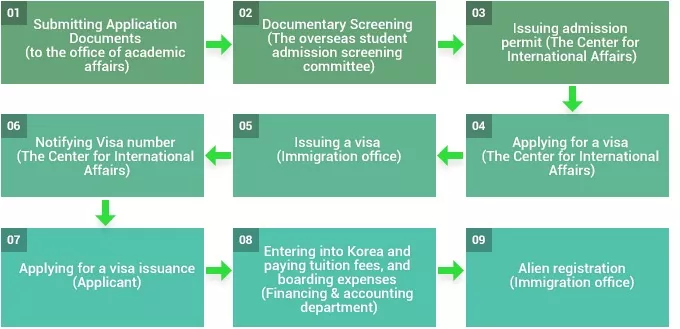

#### Application Process for Sallie Mae International Student Loan

The application process for the **Sallie Mae International Student Loan** is straightforward. Here are the steps:

1. **Gather Required Documents**: Before applying, students should gather necessary documents, including proof of enrollment, identification, and financial information of the co-signer.

2. **Complete the Application**: Students can apply online through the Sallie Mae website. The application will require personal information, details about the co-signer, and the amount needed.

3. **Credit Review**: Once the application is submitted, Sallie Mae will conduct a credit review of the co-signer. This step is crucial for determining eligibility and interest rates.

4. **Loan Approval**: If approved, students will receive a loan offer detailing the terms and conditions. It’s essential to review this offer carefully before proceeding.

5. **Acceptance and Disbursement**: After accepting the loan, funds will be disbursed directly to the educational institution, covering tuition and other expenses.

#### Why Choose Sallie Mae International Student Loan?

Choosing the **Sallie Mae International Student Loan** can be a smart financial decision for international students. With its tailored features and supportive application process, it provides the necessary funding to pursue higher education in the U.S. Additionally, the ability to have a co-signer can significantly enhance the chances of approval and secure better loan terms.

In conclusion, the **Sallie Mae International Student Loan** is a valuable resource for international students seeking financial assistance for their studies in the United States. By understanding the benefits, features, and application process, students can make informed decisions that align with their educational and financial goals.