Understanding the Impact of Loans to Family Members: A Comprehensive Guide

#### Introduction to Loans to Family MembersLoans to family members can be a beneficial financial arrangement, but they also come with their unique challeng……

#### Introduction to Loans to Family Members

Loans to family members can be a beneficial financial arrangement, but they also come with their unique challenges. This guide aims to provide an in-depth understanding of the dynamics involved in lending money to relatives, the potential risks, and how to navigate them effectively.

#### The Benefits of Loans to Family Members

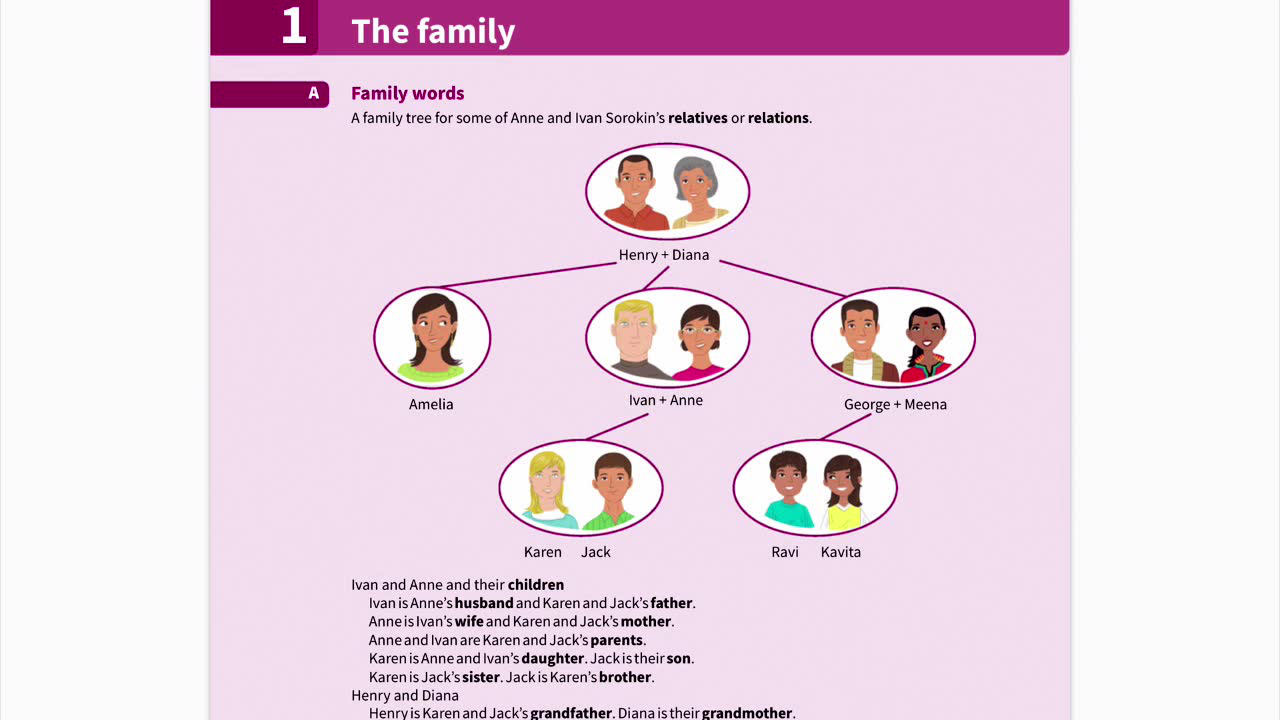

One of the primary advantages of loans to family members is the flexibility they offer. Unlike traditional banks, family members may not require strict credit checks or collateral, making it easier for individuals in need of financial assistance to access funds. Additionally, the terms of the loan can often be tailored to suit both parties, allowing for lower interest rates or even interest-free loans.

Another benefit is the emotional support that comes with lending to family. It can strengthen bonds and foster a sense of trust and responsibility. When done correctly, these loans can help family members achieve significant milestones, such as buying a home or funding education.

#### Potential Risks of Loans to Family Members

Despite the benefits, loans to family members can lead to complications. One of the primary risks is the potential for strained relationships. Money can be a sensitive topic, and if the borrower struggles to repay the loan, it can create friction and resentment. Clear communication and setting expectations upfront are crucial in mitigating these risks.

Additionally, without proper documentation, loans can lead to misunderstandings about the terms and repayment expectations. It’s essential to approach these arrangements with the same seriousness as a formal loan agreement. This includes outlining the loan amount, interest rates, repayment schedule, and any other relevant terms in writing.

#### How to Structure Loans to Family Members

When considering loans to family members, it’s vital to establish a formal structure. Start by discussing the amount needed and the purpose of the loan. This conversation should include a candid discussion about financial situations and repayment capabilities.

Once both parties agree on the terms, it’s advisable to draft a written agreement. This document should include:

- The loan amount

- Interest rate (if applicable)

- Repayment schedule

- Consequences of missed payments

Having a written agreement not only protects both parties but also serves as a reference point should any disputes arise.

#### Tax Implications of Loans to Family Members

Another critical aspect to consider is the tax implications of loans to family members. The IRS has specific rules regarding loans, particularly concerning interest rates and gift tax thresholds. If the loan amount exceeds a certain limit and is interest-free or below the market rate, the IRS may consider it a gift, which could have tax consequences for the lender.

To avoid any tax issues, it's advisable to charge a minimum interest rate, known as the Applicable Federal Rate (AFR). This ensures that the loan is considered legitimate and helps both parties stay compliant with tax regulations.

#### Conclusion: Navigating Loans to Family Members

In conclusion, loans to family members can be a practical solution for financial needs, but they require careful consideration and planning. By understanding the benefits and risks, structuring the loan appropriately, and being aware of tax implications, families can navigate this financial arrangement successfully. Open communication and transparency are key to ensuring that these loans strengthen, rather than strain, family relationships. Whether you are lending or borrowing, approach the situation with respect and clarity to foster a positive outcome for everyone involved.