Maximize Your Savings with the Pay Off Early Car Loan Calculator: A Comprehensive Guide

#### Understanding the Pay Off Early Car Loan CalculatorThe **pay off early car loan calculator** is a powerful tool designed to help car owners assess the……

#### Understanding the Pay Off Early Car Loan Calculator

The **pay off early car loan calculator** is a powerful tool designed to help car owners assess the financial benefits of paying off their auto loans ahead of schedule. By entering your loan details, such as the total amount borrowed, interest rate, and remaining term, the calculator provides insights into how much interest you can save by making extra payments or paying off the loan early.

#### Why Consider Paying Off Your Car Loan Early?

Paying off your car loan early can offer several advantages. First and foremost, it can save you a significant amount of money in interest payments. Auto loans typically have higher interest rates compared to other types of loans, and by reducing the principal balance sooner, you minimize the overall interest burden.

Additionally, paying off your car loan early can improve your credit score. A lower debt-to-income ratio and fewer outstanding debts can positively impact your credit profile. This can be particularly beneficial if you plan to make other significant purchases, such as a home or another vehicle, in the near future.

#### How to Use the Pay Off Early Car Loan Calculator

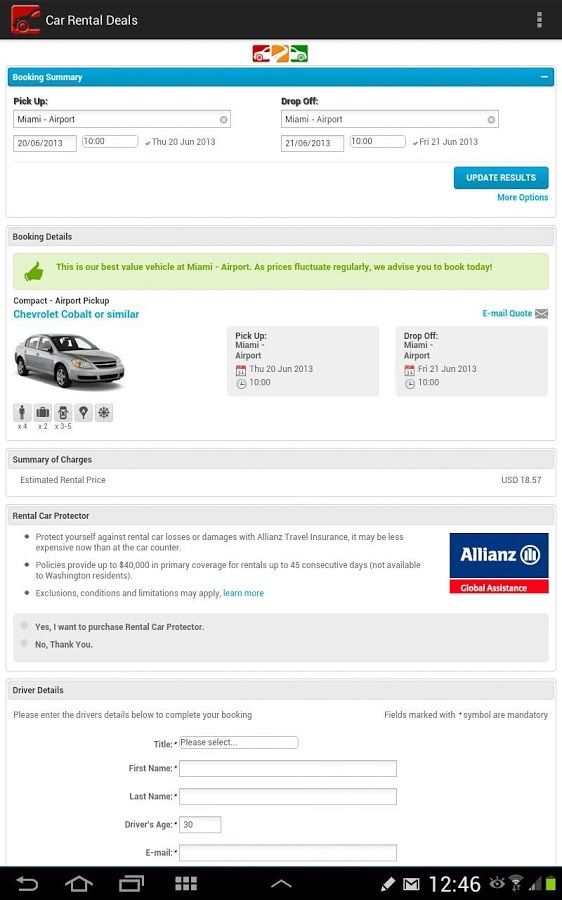

Using the **pay off early car loan calculator** is straightforward. Begin by inputting your current loan balance, interest rate, and the remaining term of the loan. Next, you can experiment with different scenarios by entering additional payment amounts or adjusting the frequency of your payments (weekly, bi-weekly, monthly). The calculator will then display the total interest saved and the new payoff date.

For instance, if you have a loan balance of $15,000 with a 5% interest rate and 3 years left, the calculator will show you how much you can save if you decide to make an extra payment of $100 each month. This allows you to make informed decisions based on your financial situation.

#### Things to Consider Before Paying Off Your Car Loan Early

While paying off your car loan early can be beneficial, there are a few factors to consider. First, check if your lender imposes any prepayment penalties. Some lenders charge fees for paying off loans early, which could negate your savings.

Additionally, ensure that you have an emergency fund in place. While it might be tempting to allocate extra funds towards your car loan, it’s crucial to maintain financial flexibility for unexpected expenses.

Lastly, evaluate your overall financial goals. If you have high-interest debt, such as credit card balances, it may be more advantageous to focus on those debts first before accelerating your car loan payments.

#### Conclusion: Take Control of Your Finances with the Pay Off Early Car Loan Calculator

The **pay off early car loan calculator** is an invaluable resource for anyone looking to take control of their auto financing. By understanding the potential savings and benefits of paying off your loan early, you can make informed decisions that align with your financial goals. Whether you're looking to save money, improve your credit score, or simply reduce your monthly obligations, this calculator can help you map out the best strategy for your situation. Start exploring your options today and see how much you can save in the long run!