Unlock Your Dream Home: A Comprehensive Guide to Using the Chase Bank Mortgage Loan Calculator

Guide or Summary:Chase Bank Mortgage Loan CalculatorBenefits of Using the Chase Bank Mortgage Loan CalculatorHow to Use the Chase Bank Mortgage Loan Calcula……

Guide or Summary:

- Chase Bank Mortgage Loan Calculator

- Benefits of Using the Chase Bank Mortgage Loan Calculator

- How to Use the Chase Bank Mortgage Loan Calculator Effectively

---

Chase Bank Mortgage Loan Calculator

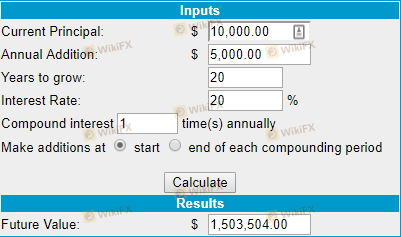

In the quest for homeownership, understanding your financial options is crucial. One of the most valuable tools at your disposal is the Chase Bank Mortgage Loan Calculator. This user-friendly online calculator helps prospective homeowners estimate their monthly mortgage payments, understand how different loan amounts and interest rates affect their payments, and plan their budgets accordingly.

Using the Chase Bank Mortgage Loan Calculator is straightforward. You simply input key details such as the loan amount, interest rate, and loan term. The calculator then provides an estimate of your monthly payment, which typically includes principal and interest. Many calculators also allow you to factor in property taxes, homeowners insurance, and private mortgage insurance (PMI) to give you a more accurate picture of your total monthly housing costs.

Benefits of Using the Chase Bank Mortgage Loan Calculator

1. **Clarity on Monthly Payments**: The Chase Bank Mortgage Loan Calculator provides clarity on what you can expect to pay each month. This is essential for budgeting and ensuring that you can afford your new home without stretching your finances too thin.

2. **Comparison of Loan Options**: By adjusting the loan amount and interest rates, you can see how different scenarios impact your monthly payments. This feature is particularly useful for comparing fixed-rate and adjustable-rate mortgages.

3. **Understanding Total Costs**: The calculator can help you understand the total cost of the loan over its lifetime, including interest payments. This insight is vital when considering how much house you can afford.

4. **Pre-qualification Preparation**: Before you even apply for a mortgage, using the Chase Bank Mortgage Loan Calculator can help you determine how much you might qualify for based on your financial situation.

How to Use the Chase Bank Mortgage Loan Calculator Effectively

To make the most out of the Chase Bank Mortgage Loan Calculator, follow these steps:

1. **Gather Your Financial Information**: Before using the calculator, have your financial data handy, including your desired loan amount, interest rate, and loan term.

2. **Experiment with Different Scenarios**: Don’t hesitate to play around with different figures. Change the loan amount or interest rates to see how it affects your monthly payment. This will give you a better understanding of what you can afford.

3. **Consider Additional Costs**: Remember to factor in additional costs like property taxes, homeowners insurance, and PMI. Some calculators allow you to include these in your estimates.

4. **Consult with a Mortgage Advisor**: After using the calculator, it may be beneficial to speak with a mortgage advisor at Chase Bank. They can provide insights tailored to your financial situation and help you navigate the mortgage application process.

The Chase Bank Mortgage Loan Calculator is an essential tool for anyone looking to purchase a home. It empowers you with the information needed to make informed decisions about your mortgage options. By understanding your potential monthly payments and total loan costs, you can approach home buying with confidence. Whether you’re a first-time homebuyer or looking to refinance, leveraging the capabilities of this calculator can set you on the path to achieving your homeownership dreams.