Understanding the Average Conventional Loan Rate: What Homebuyers Need to Know in 2023

#### Average Conventional Loan RateThe **average conventional loan rate** is a critical factor for homebuyers looking to finance their property purchases. I……

#### Average Conventional Loan Rate

The **average conventional loan rate** is a critical factor for homebuyers looking to finance their property purchases. In 2023, understanding this rate can significantly impact your decision-making process when it comes to securing a mortgage. Conventional loans are typically not insured or guaranteed by the federal government, which means they often come with different interest rates and terms compared to government-backed loans like FHA or VA loans.

#### Factors Influencing the Average Conventional Loan Rate

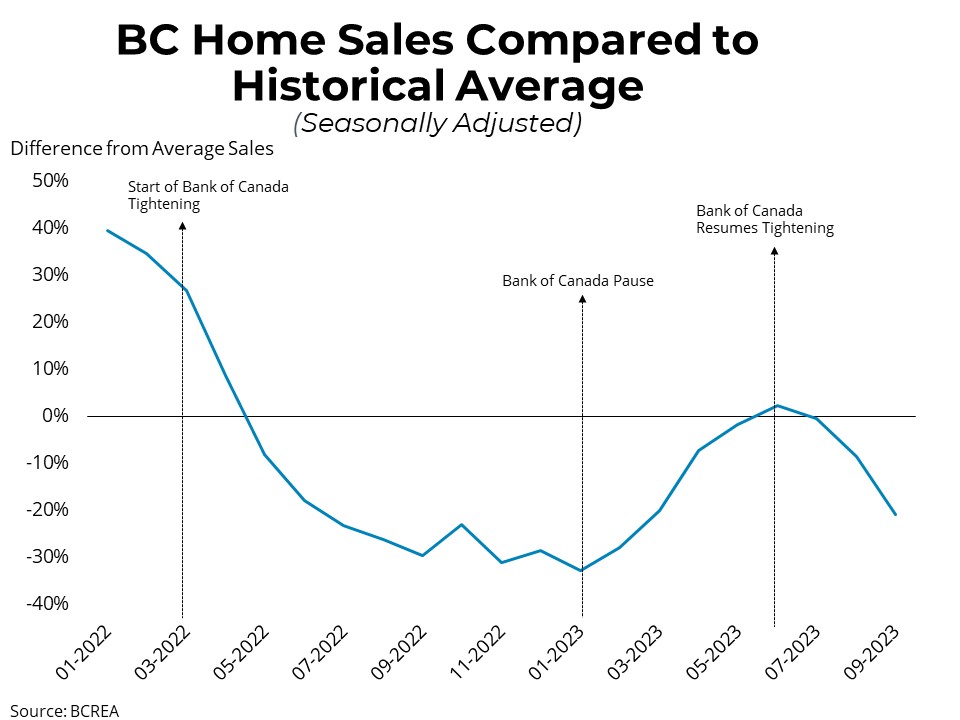

Several factors influence the **average conventional loan rate**, including economic conditions, the Federal Reserve's monetary policy, and individual borrower profiles. For instance, when the economy is strong, interest rates tend to rise as the demand for loans increases. Conversely, during economic downturns, rates may decrease to encourage borrowing.

Additionally, the Federal Reserve plays a significant role in setting the tone for interest rates. When the Fed raises its benchmark rate, it often leads to higher conventional loan rates as lenders pass on the costs to consumers. On the other hand, if the Fed lowers rates, borrowers may benefit from lower average conventional loan rates.

Individual borrower profiles also play a crucial role in determining the rate offered. Factors such as credit score, debt-to-income ratio, and down payment size can significantly affect the interest rate a borrower is eligible for. Generally, borrowers with higher credit scores and lower debt levels will qualify for more favorable rates, while those with lower scores may face higher rates.

#### How to Find the Best Average Conventional Loan Rate

To find the best **average conventional loan rate**, homebuyers should shop around and compare offers from multiple lenders. It's essential to obtain quotes from at least three different lenders to ensure you're getting a competitive rate. When comparing rates, be sure to consider the Annual Percentage Rate (APR), which includes not only the interest rate but also any associated fees, providing a more comprehensive view of the loan's overall cost.

Additionally, consider working with a mortgage broker who can help you navigate the lending landscape and find the best possible rate based on your financial profile. A broker can also provide insights into current market trends and help you understand how the **average conventional loan rate** may fluctuate in the future.

#### The Importance of Timing

Timing can also be crucial when it comes to securing a favorable **average conventional loan rate**. Interest rates can change daily based on market conditions, so being proactive and monitoring rates can help you lock in a better deal. If you notice that rates are trending upward, it may be wise to act quickly to secure a lower rate before they rise further.

#### Conclusion

In summary, the **average conventional loan rate** is an essential aspect of the homebuying process in 2023. By understanding the factors that influence this rate, shopping around for the best offers, and being mindful of timing, homebuyers can position themselves to secure the most favorable mortgage terms. As you embark on your homebuying journey, keep these insights in mind to make informed decisions that align with your financial goals.