Unlock Your Financial Freedom with Instant Approval Personal Loans: Fast, Convenient, and Hassle-Free Solutions

#### Instant Approval Personal LoanIn today's fast-paced world, financial needs can arise unexpectedly. Whether it's for medical expenses, home repairs, or……

#### Instant Approval Personal Loan

In today's fast-paced world, financial needs can arise unexpectedly. Whether it's for medical expenses, home repairs, or consolidating debt, having access to quick funds is essential. This is where an **instant approval personal loan** comes into play. These loans are designed to provide borrowers with immediate access to cash, often within a matter of hours or even minutes.

#### Benefits of Instant Approval Personal Loans

One of the most significant advantages of an **instant approval personal loan** is the speed at which funds can be accessed. Traditional loans often involve lengthy application processes, credit checks, and waiting periods that can stretch into days or weeks. In contrast, instant approval loans typically require minimal documentation and can be completed online. Borrowers can fill out an application form, submit it, and receive a decision almost immediately.

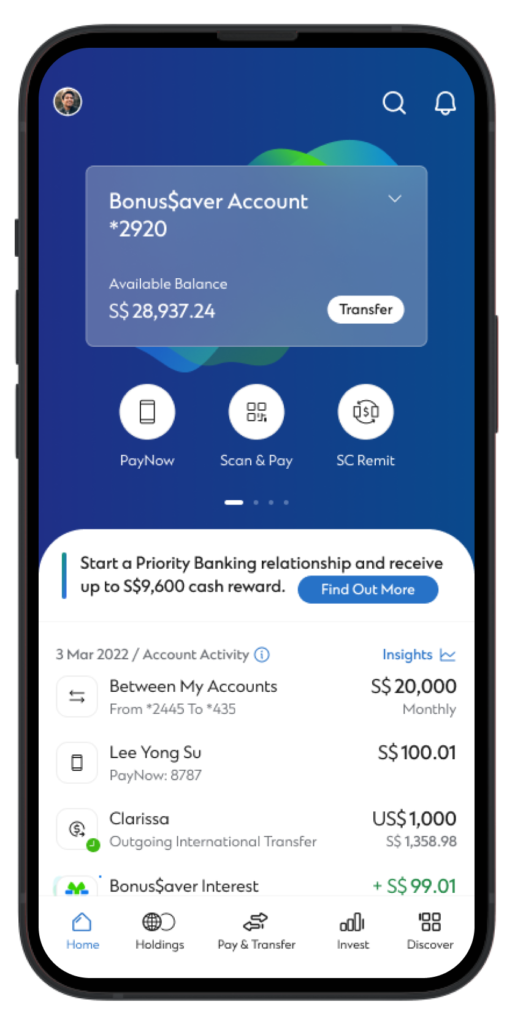

Another benefit is the convenience of applying from anywhere. With the rise of online lending platforms, borrowers can apply for an **instant approval personal loan** from the comfort of their homes or on the go. This accessibility has made it easier for individuals to secure funding without the need to visit a bank branch or meet with a loan officer.

#### Eligibility Criteria

While the application process for an **instant approval personal loan** is streamlined, lenders still have specific eligibility criteria that must be met. Generally, borrowers need to be at least 18 years old, have a steady source of income, and possess a valid bank account. Some lenders may also consider credit scores, although many offer loans to individuals with less-than-perfect credit.

#### How to Apply

To apply for an **instant approval personal loan**, follow these simple steps:

1. **Research Lenders**: Start by comparing different lenders to find one that offers competitive interest rates and favorable terms.

2. **Fill Out the Application**: Provide the necessary information, including your name, address, income, and employment details.

3. **Submit Documentation**: Some lenders may require proof of income or identification, but this is often minimal for instant approval loans.

4. **Receive Approval**: Once submitted, you will typically receive a decision within minutes.

5. **Access Your Funds**: If approved, the funds can be deposited directly into your bank account, often the same day.

#### Responsible Borrowing

While an **instant approval personal loan** can be a lifesaver in times of need, it’s crucial to borrow responsibly. Interest rates can be higher than traditional loans, so it's essential to understand the terms and ensure that you can comfortably make the repayments.

#### Conclusion

In conclusion, **instant approval personal loans** offer a fast and convenient solution for those in need of immediate funds. With a straightforward application process and quick access to cash, these loans can help individuals navigate financial challenges with ease. However, prospective borrowers should conduct thorough research and consider their financial situation before committing to a loan to ensure it aligns with their needs and capabilities. By making informed decisions, individuals can leverage the benefits of instant approval loans while maintaining their financial well-being.