No Credit Business Loans - Unlocking Opportunities for Entrepreneurs without a Traditional Credit History

Guide or Summary:No Credit Business Loans - A Tailored Solution for Non-Traditional EntrepreneursNo Credit Business Loans - The Key to Unlocking Growth and……

Guide or Summary:

- No Credit Business Loans - A Tailored Solution for Non-Traditional Entrepreneurs

- No Credit Business Loans - The Key to Unlocking Growth and Innovation

- No Credit Business Loans - Navigating the Landscape of Alternative Financing

In the bustling world of entrepreneurship, the quest for capital is often a formidable hurdle. For many budding and seasoned business owners, securing the necessary funds to fuel their ventures can be a daunting task, especially when conventional methods of financing, such as bank loans, are not accessible due to a lack of a solid credit history. Enter the realm of no credit business loans, a lifeline for entrepreneurs who may have struggled to establish a credit profile or simply prefer an alternative approach to funding their businesses.

No Credit Business Loans - A Tailored Solution for Non-Traditional Entrepreneurs

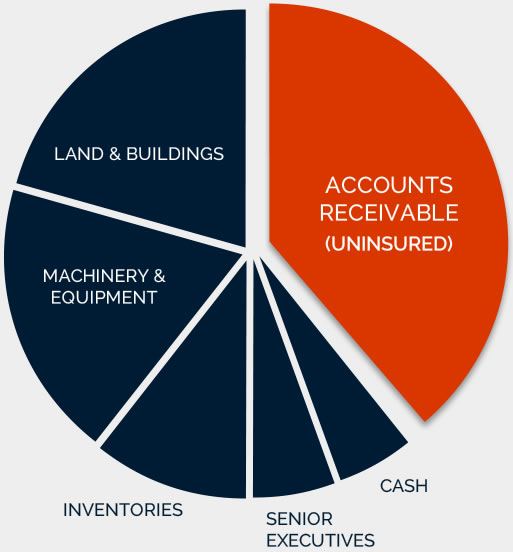

The concept of no credit business loans is not new, but its growing popularity among entrepreneurs highlights a shift in the financial landscape. These loans are designed specifically for individuals and businesses that do not have a traditional credit history or may have poor credit ratings. By leveraging alternative assessment methods, such as cash flow analysis, business plans, and the potential for future revenue, lenders can make informed decisions about lending without solely relying on a borrower's credit score.

The allure of no credit business loans lies in their flexibility and accessibility. Traditional bank loans often require a lengthy application process, collateral, and a substantial credit history, barriers that can be prohibitive for many entrepreneurs. In contrast, no credit business loans can be obtained with minimal paperwork and with little to no collateral required. This streamlined process not only saves time but also reduces the stress associated with securing the necessary funding for a business.

No Credit Business Loans - The Key to Unlocking Growth and Innovation

For many entrepreneurs, the path to success is paved with innovation, resilience, and a willingness to embrace unconventional methods. No credit business loans represent a significant step forward in this journey, offering a pathway to growth and expansion that might otherwise be inaccessible. By providing the financial resources needed to invest in new ideas, improve existing products or services, and expand market reach, no credit business loans empower entrepreneurs to drive their businesses forward with confidence.

Moreover, the availability of no credit business loans can also contribute to a more inclusive and diverse business ecosystem. Entrepreneurs from various backgrounds, including those who may have faced barriers to traditional financing due to credit history issues, can now access the capital they need to start or grow their businesses. This democratization of access to capital can lead to a more vibrant and innovative economy, with a wider range of products and services being brought to market.

No Credit Business Loans - Navigating the Landscape of Alternative Financing

While no credit business loans offer a promising solution for many entrepreneurs, it's important to approach them with a clear understanding of the risks and requirements involved. Unlike traditional loans, which often come with fixed interest rates and repayment terms, no credit business loans can vary widely in terms of interest rates, repayment schedules, and conditions. It's crucial for borrowers to carefully review the terms of any loan offer and to seek professional advice if necessary.

In conclusion, no credit business loans represent a beacon of hope for entrepreneurs who may have struggled to access traditional financing options. By providing a tailored solution that considers the unique circumstances of each business, these loans offer a flexible, accessible, and potentially transformative way to secure the capital needed for growth and innovation. As the financial landscape continues to evolve, the availability of no credit business loans will undoubtedly play a crucial role in shaping the future of entrepreneurship.