Best Senior Loan ETF: Maximizing Your Investment Potential

In today’s dynamic financial landscape, investors are constantly seeking ways to optimize their portfolios and enhance returns. One investment vehicle that……

In today’s dynamic financial landscape, investors are constantly seeking ways to optimize their portfolios and enhance returns. One investment vehicle that has gained considerable attention is the best senior loan ETF. These exchange-traded funds provide a unique opportunity for investors to gain exposure to senior loans, which are typically issued by corporations and are secured by the company’s assets. In this article, we will explore the benefits of investing in the best senior loan ETF, how they function, and what to consider when adding them to your investment strategy.

### Understanding Senior Loans

Senior loans, also known as leveraged loans, are loans made to companies that are typically rated below investment grade. These loans are senior in the capital structure, meaning they have priority over other types of debt in the event of liquidation. This seniority makes them less risky than unsecured debt, which is why many investors find them appealing. The interest rates on senior loans are often floating, which means they can adjust with changes in interest rates, providing a hedge against inflation.

### The Appeal of Senior Loan ETFs

Investing in senior loans directly can be challenging for individual investors due to the complexity of the loan market and the need for significant capital to purchase individual loans. This is where the best senior loan ETF comes into play. These ETFs pool investors’ money to buy a diversified portfolio of senior loans, allowing individuals to gain exposure to this asset class without the need to manage individual loans.

One of the primary advantages of investing in a best senior loan ETF is diversification. By holding a variety of loans from different sectors and companies, the risk associated with any single loan is mitigated. This diversification can lead to more stable returns over time. Additionally, senior loan ETFs often have lower expense ratios compared to actively managed funds, making them a cost-effective option for investors.

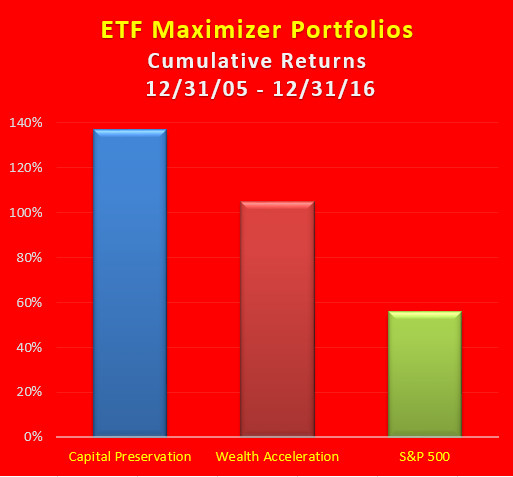

### Performance and Returns

Historically, senior loans have provided attractive returns, especially in a rising interest rate environment. The floating interest rates associated with these loans can lead to higher yields as rates increase. For investors looking for income, the best senior loan ETF can offer a steady stream of interest payments, which can be particularly appealing for retirees or those seeking passive income.

### Considerations When Investing

While there are many benefits to investing in the best senior loan ETF, there are also risks to consider. The credit risk associated with senior loans is higher than that of investment-grade bonds, as these loans are often made to companies with weaker credit profiles. Additionally, in times of economic downturn, the default rates on these loans can rise, impacting the performance of the ETF.

Investors should also be aware of interest rate risk. While floating rates can provide a hedge against rising rates, if rates were to fall, the income generated from these loans could decline, potentially leading to lower returns. Therefore, it’s essential to assess your risk tolerance and investment goals before diving into this asset class.

### Conclusion

In summary, the best senior loan ETF represents a compelling option for investors seeking to diversify their portfolios and enhance returns. With their potential for attractive yields and lower correlation to traditional equity markets, senior loan ETFs can serve as an effective tool for income generation and risk management. However, as with any investment, it’s crucial to conduct thorough research and consider your financial objectives before investing. By understanding the dynamics of senior loans and the benefits of ETFs, you can make informed decisions that align with your long-term investment strategy.