How to Get Personal Loan: Your Ultimate Guide to Securing the Best Rates

Guide or Summary:Understanding Personal LoansAssess Your Financial NeedsCheck Your Credit ScoreResearch LendersGather Necessary DocumentationSubmit Your App……

Guide or Summary:

- Understanding Personal Loans

- Assess Your Financial Needs

- Check Your Credit Score

- Research Lenders

- Gather Necessary Documentation

- Submit Your Application

- Review Loan Offers

- Accept the Loan and Manage Repayment

#### Description:

If you're looking to finance a big purchase, consolidate debt, or cover unexpected expenses, understanding how to get personal loan can be a game changer. Personal loans can provide you with the funds you need quickly, but navigating the lending landscape can be overwhelming. This comprehensive guide will walk you through the steps to secure a personal loan that suits your financial needs, ensuring you get the best rates and terms available.

Understanding Personal Loans

A personal loan is an unsecured loan that you can use for various purposes, from medical expenses to home renovations. Unlike mortgages or auto loans, personal loans do not require collateral, making them accessible to a broader range of borrowers. However, because they are unsecured, lenders typically charge higher interest rates compared to secured loans. Understanding the fundamentals of personal loans is crucial to how to get personal loan effectively.

Assess Your Financial Needs

Before diving into the loan application process, take a moment to assess your financial situation. Determine how much money you need and for what purpose. This will help you choose the right loan amount and type. Consider creating a budget to understand your monthly expenses and how much you can afford to repay. This step is vital in the process of how to get personal loan, as it sets the foundation for your borrowing strategy.

Check Your Credit Score

Your credit score plays a significant role in determining your eligibility for a personal loan and the interest rates you'll be offered. A higher credit score typically translates to better loan terms. Before applying, check your credit report for any errors and take steps to improve your score if necessary. Paying down existing debts and making timely payments can enhance your creditworthiness, making it easier to secure a loan. This is an essential part of how to get personal loan successfully.

Research Lenders

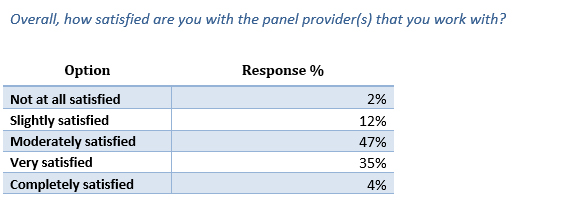

Not all lenders are created equal, so it's essential to shop around and compare your options. Look for banks, credit unions, and online lenders to find the best rates. Pay attention to the loan terms, fees, and customer reviews. Some lenders may offer prequalification, allowing you to see potential rates without affecting your credit score. This research phase is critical in the journey of how to get personal loan.

Gather Necessary Documentation

Once you've selected a lender, you'll need to gather the required documentation for your loan application. Common documents include proof of income, employment verification, and identification. Having all your paperwork in order can speed up the approval process and improve your chances of getting a favorable loan.

Submit Your Application

With your documentation ready, it's time to submit your application. Many lenders offer online applications, making it convenient to apply from the comfort of your home. Be honest and accurate in your application to avoid delays or potential rejection. This step is crucial in the process of how to get personal loan.

Review Loan Offers

After submitting your application, you'll receive loan offers from lenders. Take your time to review each offer carefully. Look beyond the interest rate; consider the loan term, monthly payment amount, and any fees associated with the loan. This thorough examination will help you make an informed decision that aligns with your financial goals.

Accept the Loan and Manage Repayment

Once you've chosen the best loan offer, accept the terms and receive your funds. It's important to manage your repayment diligently. Set up automatic payments if possible, and create a budget to ensure you can meet your monthly obligations. This proactive approach will help you maintain a positive credit history and avoid falling into debt.

In conclusion, knowing how to get personal loan is an essential skill in today's financial landscape. By understanding your needs, checking your credit score, researching lenders, and managing your loan responsibly, you can secure the funds you need while minimizing financial stress. Follow these steps to navigate the personal loan process with confidence and ease.