Understanding the Interest Rate for Personal Loans at Bank of America: What You Need to Know

#### Interest RateWhen considering a personal loan, one of the most critical factors to evaluate is the interest rate. The interest rate determines how much……

#### Interest Rate

When considering a personal loan, one of the most critical factors to evaluate is the interest rate. The interest rate determines how much you will pay in addition to the principal amount borrowed. A lower interest rate can significantly reduce the overall cost of the loan, making it essential to shop around and compare rates from different lenders.

#### Personal Loan

A personal loan is an unsecured loan that individuals can use for various purposes, such as debt consolidation, home improvements, or unexpected expenses. Unlike secured loans, personal loans do not require collateral, which means they are generally available to a broader range of borrowers. However, because they are unsecured, the interest rates tend to be higher than those for secured loans.

#### Bank of America

Bank of America is one of the largest financial institutions in the United States, offering a wide range of financial products, including personal loans. They provide competitive interest rates, flexible repayment terms, and a user-friendly online application process. Understanding how Bank of America structures its personal loan offerings can help you make an informed decision about whether to apply and how to manage your finances effectively.

#### Interest Rate Personal Loan Bank of America

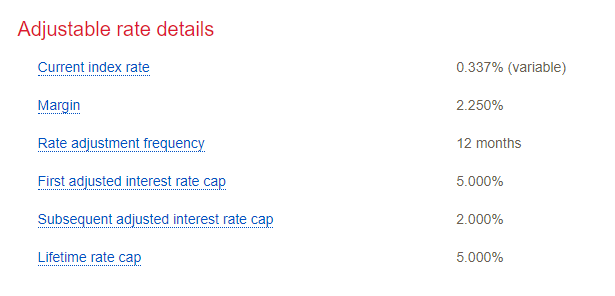

The interest rate for personal loans at Bank of America can vary based on several factors, including your credit score, income, and the amount you wish to borrow. Typically, borrowers with higher credit scores will qualify for lower interest rates, while those with lower scores may face higher rates. As of October 2023, Bank of America offers personal loan interest rates that range from approximately 6% to 30%, depending on the borrower's creditworthiness and the loan amount.

To get the best possible rate, it's advisable to check your credit report and improve your score if necessary before applying. Additionally, Bank of America often provides options for autopay discounts, which can further lower your interest rate if you set up automatic payments from your Bank of America checking or savings account.

#### Factors Influencing Interest Rates

Several factors influence the interest rate on personal loans at Bank of America:

1. **Credit Score**: Your credit score is one of the most significant factors in determining your interest rate. A higher score indicates to lenders that you are a responsible borrower, which can lead to lower rates.

2. **Loan Amount**: The amount you wish to borrow can also affect your interest rate. Smaller loans may come with higher rates compared to larger loans, reflecting the risk the lender takes on.

3. **Repayment Terms**: The length of the loan term can influence the interest rate. Shorter terms may have lower rates, while longer terms might come with higher rates due to the increased risk over time.

4. **Market Conditions**: Economic factors such as inflation and the Federal Reserve's interest rate decisions can impact the rates offered by lenders, including Bank of America.

#### Conclusion

In summary, understanding the interest rate for personal loans at Bank of America is crucial for making informed financial decisions. By considering factors such as your credit score, loan amount, and repayment terms, you can position yourself to secure a favorable rate. Always compare offers from multiple lenders to ensure you are getting the best deal possible. Remember, a lower interest rate can save you significant money over the life of the loan, making it an essential consideration in your borrowing strategy.