"Understanding the Mortgage Loan Interest Rate Today: What Homebuyers Need to Know"

Guide or Summary:Mortgage Loan Interest Rate TodayThe Importance of Mortgage Loan Interest RatesFactors Influencing Today's Mortgage RatesHow to Find the Be……

Guide or Summary:

- Mortgage Loan Interest Rate Today

- The Importance of Mortgage Loan Interest Rates

- Factors Influencing Today's Mortgage Rates

- How to Find the Best Mortgage Loan Interest Rate Today

- The Impact of Credit Scores on Mortgage Rates

- Long-Term vs. Short-Term Mortgage Rates

Mortgage Loan Interest Rate Today

In the world of real estate, one of the most critical factors that can influence a homebuyer's decision is the mortgage loan interest rate today. This rate not only affects how much a buyer will pay monthly but also impacts the overall cost of the home over the life of the loan. With fluctuations in the economy, it's essential for potential buyers to stay informed about current rates and trends.

The Importance of Mortgage Loan Interest Rates

The mortgage loan interest rate today serves as a barometer for the housing market. When rates are low, more buyers are encouraged to enter the market, which can lead to increased competition and rising home prices. Conversely, when rates are high, the pool of potential homebuyers may shrink, leading to a slower market. Understanding these dynamics is crucial for anyone looking to purchase a home.

Factors Influencing Today's Mortgage Rates

Several factors contribute to the mortgage loan interest rate today. These include economic indicators such as inflation, employment rates, and the Federal Reserve's monetary policy. When the economy is strong, rates tend to rise as the demand for loans increases. Conversely, in times of economic uncertainty or recession, rates may be lowered to stimulate borrowing and spending.

How to Find the Best Mortgage Loan Interest Rate Today

For homebuyers, finding the best mortgage loan interest rate today requires research and comparison. Various lenders offer different rates, and it's essential to shop around. Online comparison tools can help buyers evaluate their options quickly. Additionally, working with a mortgage broker can provide access to multiple lenders and potentially better rates.

The Impact of Credit Scores on Mortgage Rates

Another critical aspect that affects the mortgage loan interest rate today is the borrower's credit score. Generally, individuals with higher credit scores qualify for lower interest rates. Therefore, it's advisable for prospective buyers to check their credit reports and improve their scores before applying for a mortgage. This could mean paying down debts, making timely payments, or disputing any inaccuracies on their credit report.

Long-Term vs. Short-Term Mortgage Rates

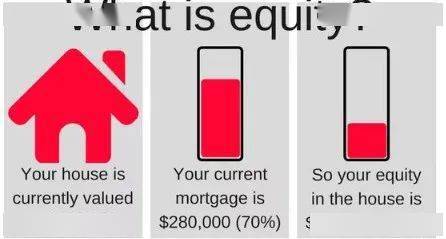

When considering the mortgage loan interest rate today, buyers should also think about the type of mortgage they want. Fixed-rate mortgages offer stability, as the interest rate remains the same throughout the loan term. On the other hand, adjustable-rate mortgages may start with lower rates but can fluctuate over time, potentially leading to higher payments in the future. Understanding the differences between these options is crucial for making an informed decision.

In conclusion, the mortgage loan interest rate today is a vital element for anyone looking to purchase a home. By staying informed about current rates and understanding the factors that influence them, homebuyers can make strategic decisions that align with their financial goals. Whether you're a first-time buyer or looking to refinance, being proactive in your research can lead to significant savings and a more favorable mortgage experience.